(Source: Canva.com)

You may have already heard the news that shocked the internet yesterday…

“Elon Musk took a 9.2% stake in Twitter Inc. to become the platform’s biggest shareholder, a week after hinting he might shake up the social media industry,” wrote Bloomberg.

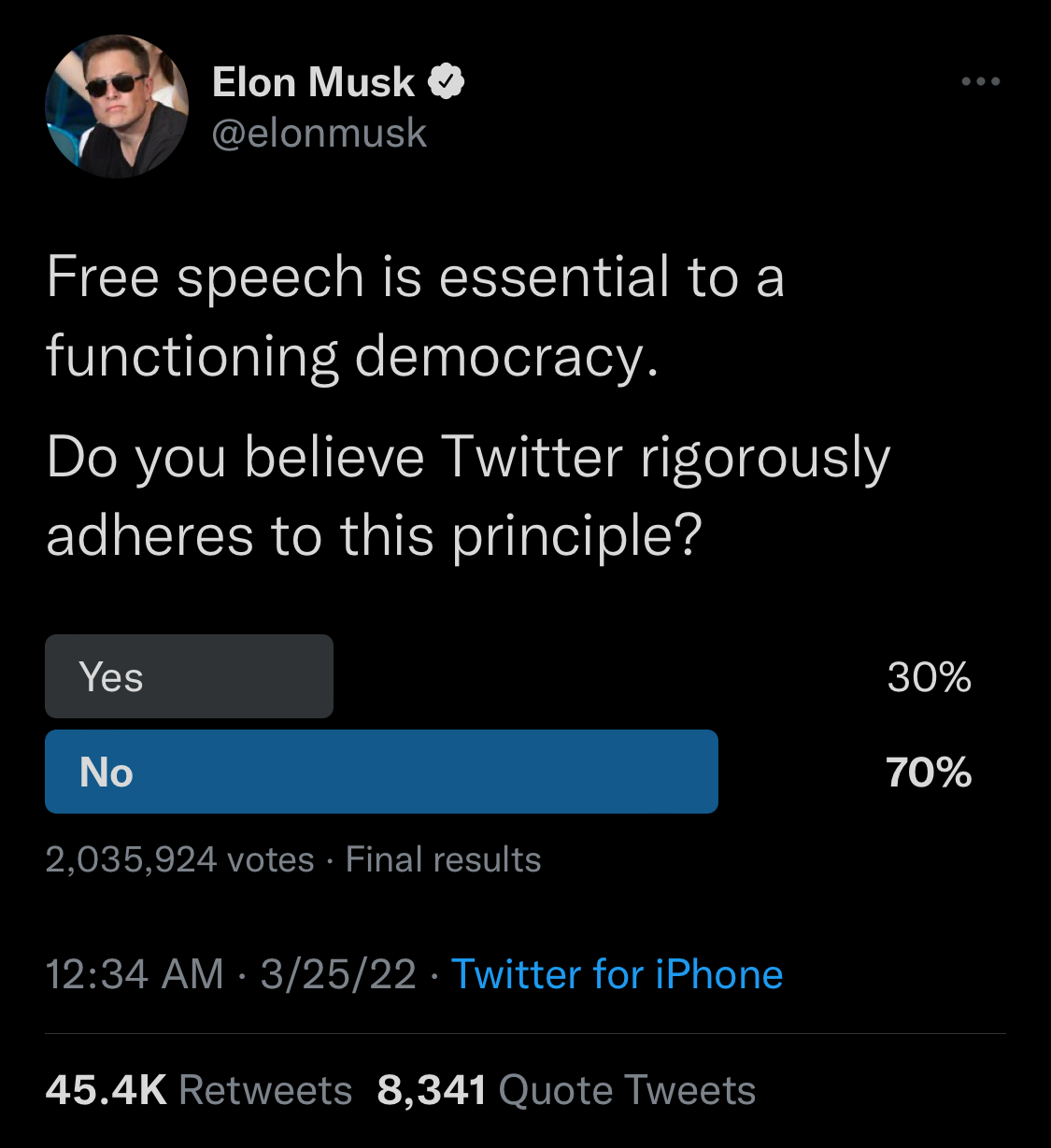

Following the Twitter poll results from a March 25 tweet, Elon Musk decided to do something about the perceived freedom of speech issue on Twitter.

As nothing Musk does flies under the radar, the move caused Twitter shares to surge:

…as much as 27% after Musk’s purchase was revealed Monday in a regulatory filing. The gain marked the stock’s biggest intraday increase since its first day of trading following the company’s 2013 initial public offering. Musk’s stake is worth about $2.89 billion, based on Friday’s market close.

More non-REIT News

Another big story creating waves are the major gas companies having record quarters.

According to Yahoo! Finance, “Exxon Mobil Corp. signaled its highest profit since 2008 as Russia’s war in Ukraine upended global commodity markets.”

This comes as American’s are struggling to pay for gas at the pumps. Exxon is not the only one either both Shell plc and BP plc also had record high profits recently leading the public to believe that the higher gas prices were not as necessary for these billion dollar companies.

As a result:

Key Democrats in the U.S. House of Representatives demanded Exxon and peers Chevron Corp., Shell Plc and BP Plc immediately halt dividends and share buybacks until the war’s conclusion, and scolded them for “profiteering off the crisis in Ukraine.

I am curious to see how this will play out. Given the unknowns of the Russia-Ukraine war, did the companies tighten up and then realize margins were higher than needed to account for potential losses? It certainly seems they now need to reassess their margin of profit; otherwise they will continue profiting off this crisis—and a lot of folks are out there watching right now.

The World According to REITs

Prologis (PLD), the largest REIT in the world, made the news yesterday as its “market cap of $120 billion recently scored a breakout from a buy point.” The article above suggested it’s time to buy, while MarkWatch took this as a sign that the stock was underperforming in compared to its peers:

Shares of Prologis Inc. PLD, -1.22% slipped 1.22% to $163.78 Monday, on what proved to be an all-around positive trading session for the stock market, with the S&P 500 Index SPX, +0.81% rising 0.81% to 4,582.64 and the Dow Jones Industrial Average DJIA, +0.30% rising 0.30% to 34,921.88. Prologis Inc. closed $6.15 short of its 52-week high ($169.93), which the company achieved on December 31.

I don’t recommend buying PLD, but it is always good to keep a close eye on the largest REIT in the industry as a matter of sector health. Even the largest REIT in the industry is feeling the weight of the times at the moment. I am happy to report, my investments are still doing well.

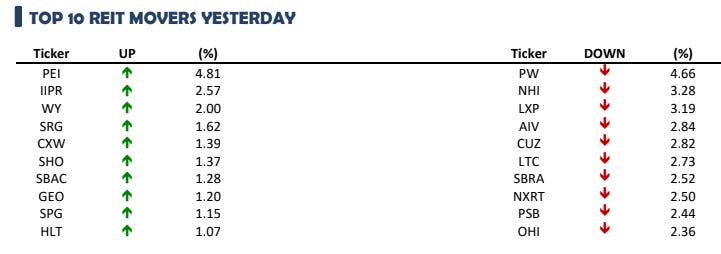

Finally, some updates from the Daily REITBeat:

Welltower Inc. (WELL): Announced a business update commenting that average year-over-year occupancy growth in Q1 2022 is expected to exceed previous assumptions for a 420-basis-point increase. Sequential average occupancy growth from Q4 2021 to Q1 2022 is also expected to exceed previous estimates for approximately flat growth… And spot occupancy increased approximately 40bps during the quarter, with significant acceleration into April. Management noted that it “expect(s) Q1 2022 normalized funds from operations (FFO) per diluted share to exceed midpoint of $0.79–0.84 guidance range.”

Equinix, Inc. (EQIX): Completed its deal to acquire West African data center and connectivity solutions provider MainOne for an enterprise value of $320M, marking the beginning of its expansion into Africa. MainOne’s assets include four operational data centers, which will add more than 64,000 gross sf of space to Platform Equinix, in addition to 570,000 square feet of land for future expansions and an extensive submarine network extending 7,000 kilometers from Portugal to Lagos, Accra along the West African coast.

Ryman Hospitality Properties, Inc. (RHP): Announced that Atairos, along with its long-term strategic partner NBCUniversal, will acquire a 30% minority ownership stake in its subsidiary OEG Attractions Holdings LLC, which directly or indirectly owns the assets that comprise Opry Entertainment Group. The announcement noted that Atairos’ investment values OEG at $1.415 billion, inclusive of OEG’s previously announced acquisition of Block 21 (which is expected to close prior to June 1, 2022, subject to certain closing conditions). RHP has agreed to make an additional $30 million investment in OEG, contingent on certain performance targets being achieved, which would bring OEG’s valuation to $1.515 billion.

(The Daily REITBeat)

Stay the course! Don’t let the Mr. Market’s emotions take away your peace in one of the safest real estate sectors.

Want more insider information and analysis – without any strings attached?

Sign up for my free Intelligent REIT Daily e-letter today to get more of the stuff profitable portfolios are made of!